Study Finds Wives Often Lose When Husbands Take Social Security Early

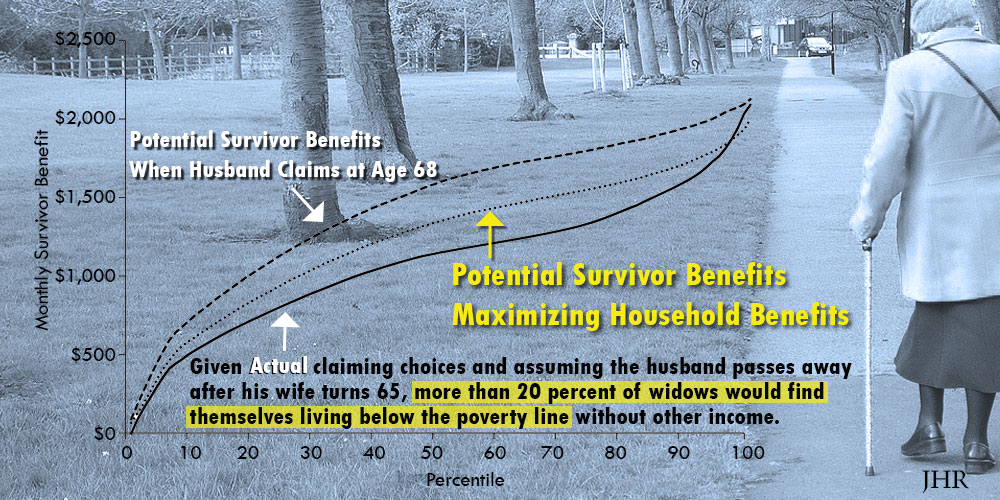

Social Security provides a large portion of household income in old age. Most women receive at least some Social Security benefits over their lifetime based upon their husbands’ work record, and this will continue even as women are more attached to the labor market and receive higher wages. Unfortunately for many wives, the age her husband begins receiving Social Security benefits can have a spillover effect and also impact her lifetime benefits.

A recent study by Alice Henriques (Board of Governors, Federal Reserve System) finds that part of the reason for this outcome is that husbands respond to the financial incentives tied to their own benefits but not to the incentives tied to the benefits received by their wives.

The incentives faced vary across couples because each individual faces different benefit rules and because earnings histories (which have a direct impact on benefits) also vary widely within the population. Previous studies of how people respond to Social Security benefit formulas have considered all benefits at the household level, while this study points out the importance of considering each type of benefit in isolation.

Thus, the impact of husbands only responding to their own incentives can have costly consequences for the wife, with over 40% of wives losing more than $10,000 in expected lifetime benefits.

Henriques suggests: “When planning for a successful retirement, couples should take into account the full spectrum of potential Social Security benefits for each spouse. There is no single approach for all couples, but Social Security benefits should be fully considered in conjunction with other sources of retirement income.”

Read the full study in the Journal of Human Resources: “How Does Social Security Claiming Respond to Incentives? Considering Husbands’ and Wives’ Benefits Separately” by Alice M. Henriques